3.04 What are the types of charts? How to read a chart?

This lesson explains how to read a chart and types of charts in technical analysis.

While trading any asset including cryptocurrencies, charts are crucial in technical analysis. They are like the heart and soul of technical analysis. By learning how to read a chart and observing different chart patterns and trends, you can make an informed decision and increase the chances of making profits.

The usage of charts is very popular among the trading community. In fact, technical analysts are often referred to as “chartists” because their work revolves around different types of charts. Many years back, charts were drawn by hand but nowadays, they are generated using computers.

This lesson explains how to read a chart and types of charts in technical analysis.

Contents

- Types of charts used in technical analysis

- How to read a chart?

Types of charts used in technical analysis

Charts are graphical displays of the price and volume movements of assets in a given period. This information can be represented in different types of charts in several ways.

Charts are an indispensable element of technical analysis. Technical analysts use a variety of charts based on the information they need. It is their job to choose a suitable chart type to bring out a hidden trend. There are many types of charts.

- Line charts

- Bar charts

- Candlestick charts

- Point and Figure charts

- Renko charts

- Kagi charts

- Area charts

Among all these types of charts, the most popular ones are line charts, bar charts, and candlestick charts. Let’s discuss them below.

Line Charts

Line charts are the most basic form of charts and they contain the least amount of information. These charts are composed of a single line from left to right that links the closing prices in a given time period.

Line charts help you to get a general idea of the price movement of an asset. Some traders who consider that the closing price is more important than the opening, high, and low prices will prefer these charts. You can spot trends in the price movements by looking at a line chart. However, it is not very helpful when it comes to intra-day trading. Line charts are generally used in presentations and reports to get a glimpse of the historical and current direction.

Bar Charts

Bar charts are also referred to as open-high-low-close (OHLC) charts. They are composed of a series of vertical lines which indicate the price range during the given period.

When compared to line charts, bar charts give much more information. This is because each plot in the bar chart is represented by a vertical line instead of dots. Each line has two horizontal lines on both sides, representing opening and closing prices. Whereas, the top part of the vertical line indicates the highest price and the lower part shows the lowest price of the asset.

In addition to offering more details, bar charts also give insight into the price volatility of an asset. If the vertical line is longer, we can conclude that there is more volatility in the specified time. The period is the time interval chosen for the analysis. For example, 5 minutes in the case of short-term analysis or 6 months for a longer period.

Candlestick Charts

Candlestick charts represent more details in a precise manner. They also describe four data points - open, high, low, and close prices. Candlestick charts are very popular charts among technical analysts.

Candlestick charts are the most illustrative charts that belonged to the earliest used forms of technical analysis by the Japanese. As the name suggests, the price movements of an asset are represented in the form of a candlestick. By using these charts, you can most intuitively interpret the price movements on the charts.

There are three main components of candlestick charts - main body, sticks, and color. The main body represents the opening and closing prices whereas the shadows/sticks tell us the highest and the lowest price in the specific period. Chart patterns are formed both by the main body and the shadows.

Another important component of candlestick charts is the color of the main body. A falling candlestick is represented by red or black color while a rising candlestick is colored either green or white. Candlestick charts give the information clearly and precisely when compared to bar charts. You can learn more about candlestick charts and formations in the next lesson.

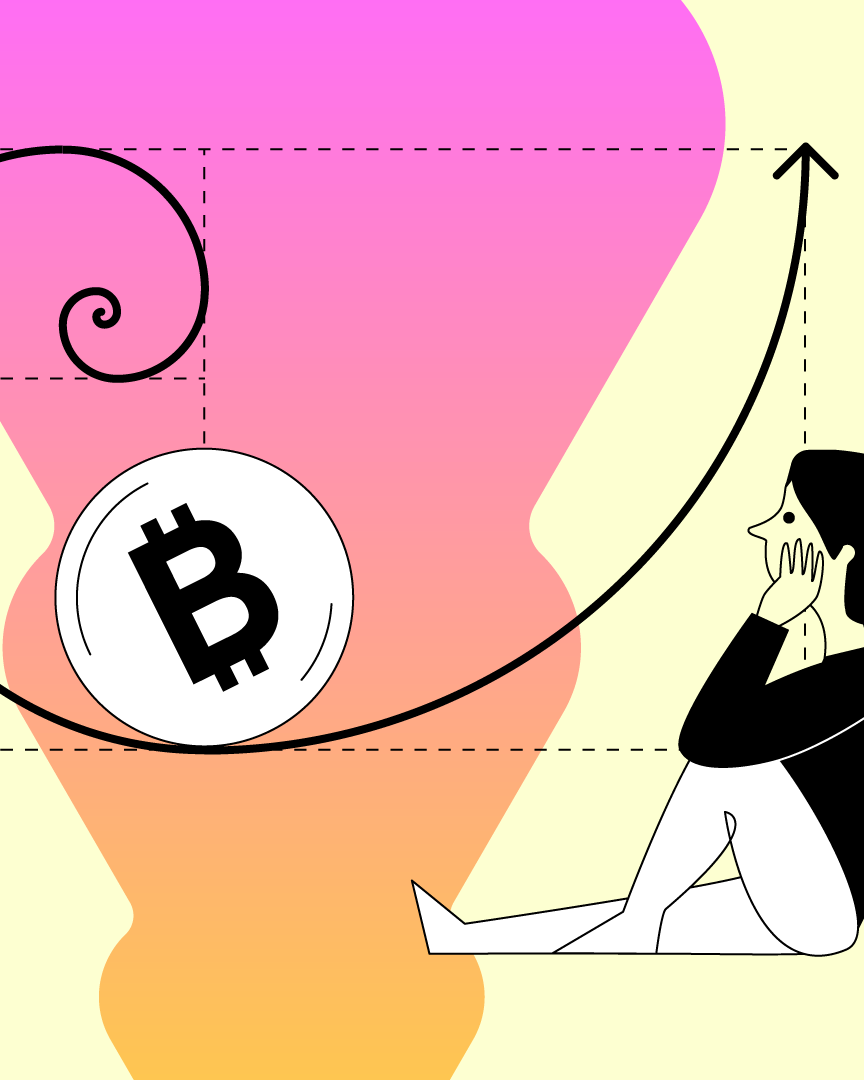

How to read a chart?

Charts reflect the value of one stock against another at a time. On the vertical axis, we have a value expressed in the quote currency, while the horizontal axis shows time.

Let’s take the below chart as an example. It is a BTC/USD chart where the vertical axis shows the value expressed in US dollars that you have to pay at a given moment (horizontal axis) for one Bitcoin.

We hope you get a better idea of different types of charts. Our next lesson will explain candlestick charts in more detail.

DISCLAIMER

This material does not constitute investment advice, nor is it an offer or solicitation to purchase any cryptocurrency assets.

This material is for general informational and educational purposes only and, to that extent, makes no warranty as to, nor should it be construed as such, regarding the reliability, accuracy, completeness or correctness of the materials or opinions contained herein.

Certain statements in this educational material may relate to future expectations that are based on our current views and assumptions and involve uncertainties that could cause actual results, performance or events to differ from those statements.

BB Trade Estonia OU and its representatives and those working directly or indirectly with BB Trade Estonia OU do not accept any liability arising from this article.

Please note that investing in cryptocurrency assets carries risks in addition to the opportunities described above.