3.05 Candlestick charts and patterns

This lesson focuses on understanding candlestick charts and patterns.

As a beginner, you may be wondering if you need to study economics to read Japanese candlestick formations. The answer is no. In this lesson, we will teach you what the price chart in the form of candlesticks is.

This lesson focuses on understanding candlestick charts and patterns.

Contents

- Understanding candlesticks

- Construction of a Japanese candle

- Using the candlestick charts

Understanding candlesticks

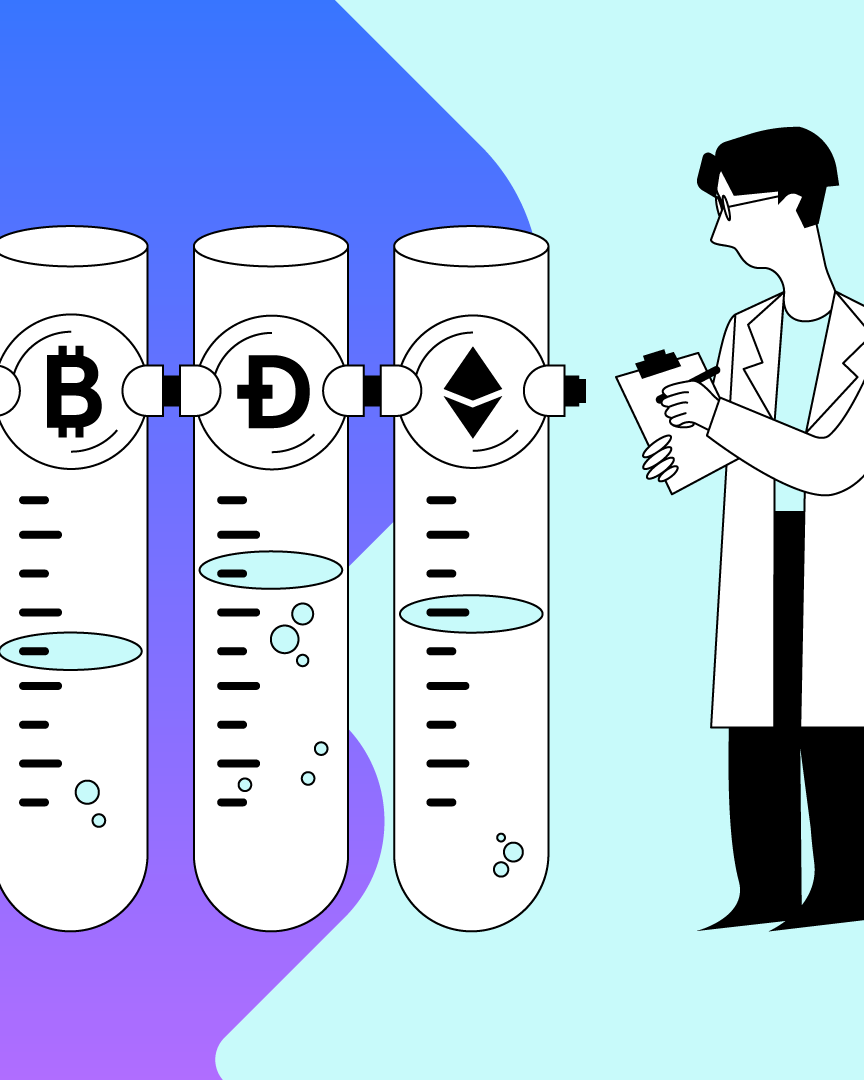

The method originates from Japan. The inventor was Munehisa Homma, a rice trader who lived in the 18th century. After gaining popularity in Japan, the technique started finding acceptance in Europe and America in the 1990s. Candlestick charts are now widely used for financial markets, including digital assets.

The inventor of the candlesticks discovered that the markets were heavily influenced by traders’ emotions. Candlesticks deciphered this emotion by representing the price moves in a visual form.

Let’s take a look at the BTC/EUR chart - one of the most popular cryptocurrency pairs on zondacrypto. The figure visually represents a chart consisting of candles. Depending upon the interval, one candle corresponds to the subsequent period. For instance, one candle corresponds to one day in the daily chart. If it were a weekly chart - one candle would correspond to one week.

Construction of a Japanese candle

A single candle contains four pieces of information:

- Open price

- Maximum price

- Minimum price

- Close price

You may have come across the term OHLC while studying cables. They reflect the above-listed points in the following manner.

O - Open, H - High, L - Low, C - Close.

Candlesticks go up when the closing price is higher than the opening price. Alternatively, they fall when the closing price is lower than the opening price.

Apart from these four pieces, color is the fifth piece of information that comes into play. The color indicates whether the candle is rising or falling.

You can also adjust the color depending on your preference. The default setting is a white background, where green candles (with black borders to make them visible against a white background) are up candles. In contrast, red candles are down candles, indicating a bearish market behavior.

Body and wick

The other important information is that each candle has its body and wick:

As indicated in the illustration, the candle has the opening price at the top and closing price at the bottom. The opening and closing prices determine the boundaries of the candle body and its color.

If the price has increased since the beginning of the analyzed period, the candle’s body is green with the opening price at the bottom and the closing price at the top. Alternatively, the candle is red if the price has fallen since the beginning of the analyzed period.

On the other hand, the length of the upper and lower wicks is determined by the lowest and highest price values in the analyzed period.

Using the candlestick charts

Traders use the candlestick charts to look for specific formations. Let’s take a look at the most popular candlestick formations below.

Doji

The formation is called a Doji candle when the opening and closing prices are practically the same. However, as you can see in the picture, these candles may differ from each other. The length of the wick (shadow) can take different sizes in distinct situations.

Doji tells us that there is a fight between buyers and sellers in the market in which neither side can tip the scales to their side. As a result, uncertainty and indecision increase. At this point, it's best to wait and take a coffee break - market forces will solve the problem on their own.

Engulfing patterns

The Engulfing patterns are two-candlestick patterns of trend reversals. Traders use the engulfing pattern to open the trade while anticipating a possible trend reversal. The engulfing candle can be bullish or bearish depending on its location in the current trend.

Bullish engulfing is formed at the bottom of the downtrend and bearish engulfing is formed at the top of the uptrend. It is categorized as a double candlestick pattern since it is formed by two candles.

The Bullish Engulfing pattern indicates a possible trend change from downtrend to uptrend and consists of the first red candle and the second green candle, the body of which completely encompasses the first candle body. The opening of the second candle is below the closing (not the minimum) of the previous candle and the closing is above the opening of the first candle.

In the Bearish Engulfing pattern, the situation is similar, i.e., the body of the second candle completely covers the body of the first candle, but the first candle is “demand,” and the second is “supply.” In these patterns, shadows do not matter that much. We also call an engulfing situation in which the bodies of the candles will be equal to each other, but it is better when the body of the first candle is much smaller than the second candle.

Hammer

In a Hammer pattern, you can see a small body close to the top wick with no bottom or very short bottom wick. This formation is considered to be a bull in a downtrend. It simply tells us when the sellers had control, and at what point the buyers managed to take control - as a result, the price goes up again around the opening level or higher.

It is noteworthy to consider that the hammer does not indicate a complete takeover of buyers but suggests an increase in their strength and, most likely, an increasing number of buy transactions.

Shooting Star (aka Falling Star)

The most popular and distinctive single candlestick pattern for reversing the uptrend (announcing downturns) is the Falling Star pattern. The construction of this candle is identical to that of the Hammer, but the difference is that it appears after increases. A shooting star has a long top shadow, a small body (red or green), and little or no bottom shadow. The top shadow should be 2 to 3 times larger than the body. On the other hand, as it already appears, the lower shadow cannot be larger than the body (or it cannot occupy more than 20% of the entire candle). This formation signals a decline following an uptrend.

Candlestick charts and patterns present an effective way to visualize market trends depicted by traders’ behavior. Reading candles may help you better understand and follow the market movements. This, in turn, helps in making investment or trading decisions in cryptocurrency markets.

In the next lesson, we look at the basics of the support and resistance levels.

DISCLAIMER

This material does not constitute investment advice, nor is it an offer or solicitation to purchase any cryptocurrency assets.

This material is for general informational and educational purposes only and, to that extent, makes no warranty as to, nor should it be construed as such, regarding the reliability, accuracy, completeness or correctness of the materials or opinions contained herein.

Certain statements in this educational material may relate to future expectations that are based on our current views and assumptions and involve uncertainties that could cause actual results, performance or events to differ from those statements.

BB Trade Estonia OU and its representatives and those working directly or indirectly with BB Trade Estonia OU do not accept any liability arising from this article.

Please note that investing in cryptocurrency assets carries risks in addition to the opportunities described above.